Forecasting the Great Recession in the United States:First Results from a Model Comparison Exercise

Forecast comparison of pre-crisis models during the Great Recession

Forecast comparison of pre-crisis models during the Great RecessionAbstract

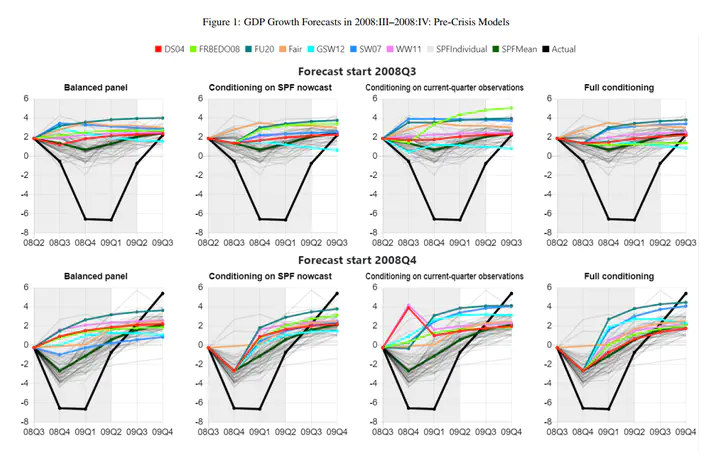

Macroeconomists have been criticized for failing to predict the massive macroeconomic effects of the Global Financial Crisis. As part of this criticism, the usage of DSGE models without financial frictions has been questioned. In response, during the last decade a good many new models with financial frictions have been developed. In this paper, we compare forecasts of the Great Recession based on a range of post-crisis NK-DSGE models embedding financial frictions with forecasts from professional forecasters as well as forecasts based inter alia on NK-DSGE models developed prior to the crisis, a Cowles Commission model and Bayesian VARs. A forecasting experiment based on recursive estimation using real-time data vintages provides evidence that NK-DSGE models embedding a financial accelerator and information provided by higher-frequency data, specifically on credit spreads, produce high-quality GDP nowcasts at the onset of the Great Recession. These models can also detect the beginning of this recession earlier than pre-crisis models as well as post-crisis models that do not embed the same higher-frequency information. Furthermore, forecasts from the pre-crisis models and those from professional forecasters tend to strongly underpredict the extent of the Great Recession. The post-crisis NK-DSGE models that make use of higher-frequency credit-sprea<d information in addition yield better forecasts than similarly informed unrestricted Bayesian VARs. Nonetheless, like the professional forecasters, not even these post-crisis models succeed in predicting the Great Recession prior to its onset. We extend the analysis to two additional recessions. For the 2001 recession we do not find systematic improvements in forecasting accuracy based on post-crisis models. Regarding the 2020 recession, we find that models that focus on labor market dynamics deliver the most accurate forecasts, while there is no systematic difference between pre- and post-crisis models. Hence, these results indicate that post-crisis models improve forecasting accuracy during recessions caused by financial crises, but not during other recessions.