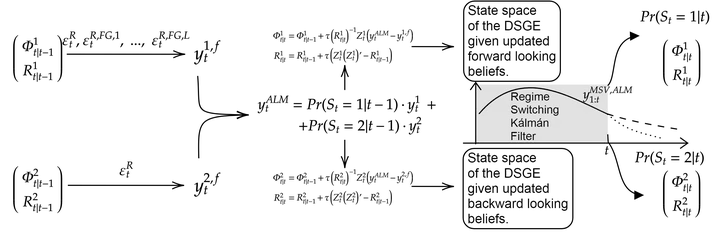

Endogenous belief switching diagramm

Endogenous belief switching diagrammAbstract

Forward guidance has emerged as a crucial tool for central banks as short-term interest rates approach the zero lower bound. While economic theory has extensively examined the effectiveness of unconventional monetary policy, recent attention has focused on the fundamental role of expectations in macroeconomic models. However, limited research exists on forward guidance in an adaptive learning environment, particularly when expectations become adaptive at the zero lower bound. This paper aims to address this gap by investigating the forward guidance puzzle within an adaptive learning framework and emphasizing the significance of monetary policy in expectation formation. To explain the role of learning and dynamic expectation formation in the context of unconventional monetary policy, I propose the framework of endogenous belief switching. This framework combines rational and adaptive learning approaches to solve the forward guidance puzzle. It posits that expectations are determined by central bank actions, making the effectiveness of forward guidance endogenous - I allow agents to learn the transmission of pre-announced policy rate changes based by alternating between forward-looking beliefs or focusing solely on current conditions and forming backward-looking beliefs. I endogenize belief switching by incorporating a mean squared learning transition between these two belief regimes. Agents update their beliefs every period using a switching Kálmán filter, which allows them to dynamically determine whether to adopt a forward-looking or backward-looking perspective based on the probability that either regime best describes the economy. Simulation results demonstrate that the effectiveness of forward guidance is nonlinear. When agents are adaptive and backward-looking, the forward guidance puzzle does not arise. However, if expectations are adaptive and forward-looking, the puzzle emerges. The framework predicts that forward guidance is highly effective in low uncertainty environments, where the model aligns well with the data and observation error is minimal. Conversely, in high uncertainty economies, forward guidance can become ineffective. In such cases, agents may opt to become backward-looking due to excessive noise relative to the signal provided by forward guidance. However, agents can learn to trust the central bank if it conveys a strong enough signal regarding its commitment.