On the effectiveness of macroprudential policy

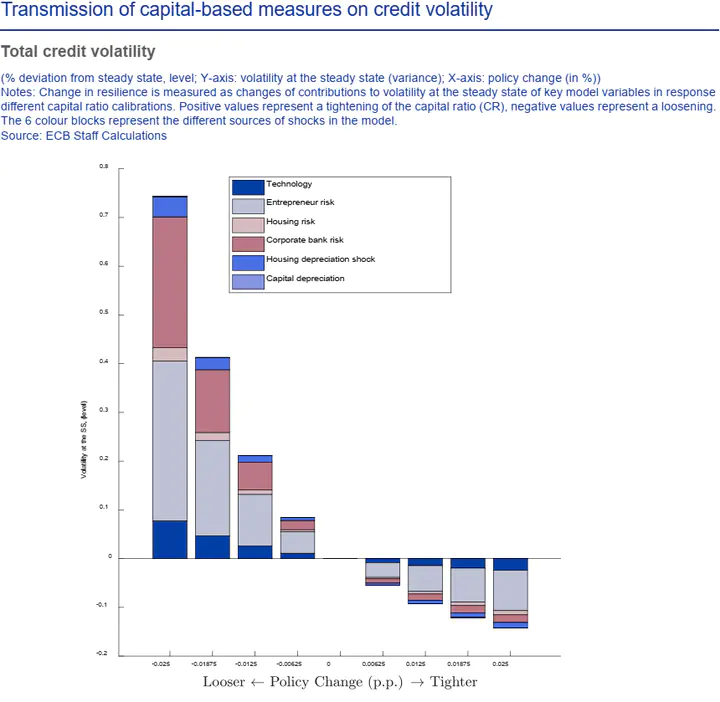

Transmission of capital-based measures on credit volatility in the 3D model

Transmission of capital-based measures on credit volatility in the 3D modelAbstract

Since the global financial crises, many countries have implemented macroprudential policies with the aim to render the financial system more resilient to shocks and limit the procyclicality of the financial system. We present theoretical and empirical evidence on the effectiveness of macroprudential policy, on both, financial stability and economic growth focussing on capital measures and borrower-based measures.

Type

Publication

ECB Working Paper No 2559