Risk taking at the ZLB in response to QE

Risk taking at the ZLB in response to QEAbstract

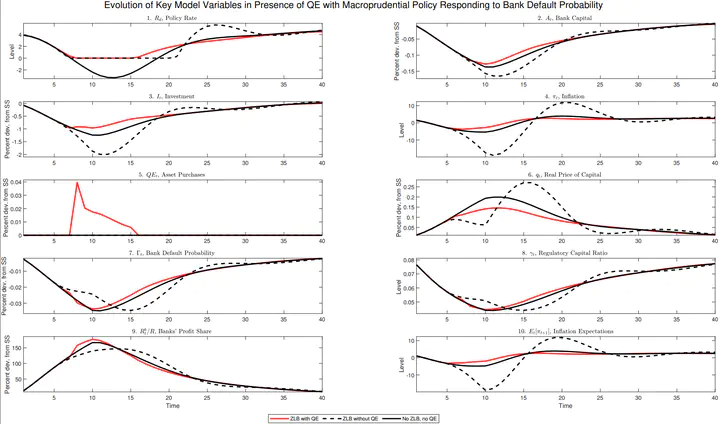

This paper identifies the impact of unconventional monetary policy using narrative sign restrictions and assesses its merits at the zero lower bound (ZLB) in a calibrated DSGE with endogenous riskiness driven financial frictions and counter-cyclical bank capital regulation. In the empirical section the impact of unconventional monetary policy of the ECB is identified using narrative sign restrictions. Then I present a theoretical model to capture quantitative easing (QE) in a DSGE model featuring an occasionally binding zero lower bound and counter-cyclical macroprudential policy. I calibrate the model using optimal simple rules for both monetary and macroprudential policy. The model is closed by specifying feedback rules both for monetary and macroprudential policy with coefficients derived by an optimal simple rule problem. Solving the model for optimal coefficient provides a first validation of the the model since, optimal coefficients fit both historical Taylor-rule coeffcients as well as the Basel III type of counter-cyclical regulation. Finally, the model is used to assess QE’s merits in presence of endogenous risk taking and optimal counter-cyclical bank leverage regulation. The model successfully captures two channels of QE, the signalling and bank capital relief. First, by construction, the model is calibrated to match the impact of QE - due to an earlier and smoother transition from the ZLB to normal times implied yields drop and inflation expectations increase. Second, it predicts that QE shifts the return distribution in favor of banks. The model explains why optimal counter-cyclical macroprudential policy should be reconsidered in light of unconventional policy. Simulations show that in absence of QE excessive risk taking at the ZLB is present. They also indicate that concerns of QE driven endogenous risk taking are unwarranted.