Risks of inflation expectation de-anchoring

Risks of inflation expectation de-anchoringAbstract

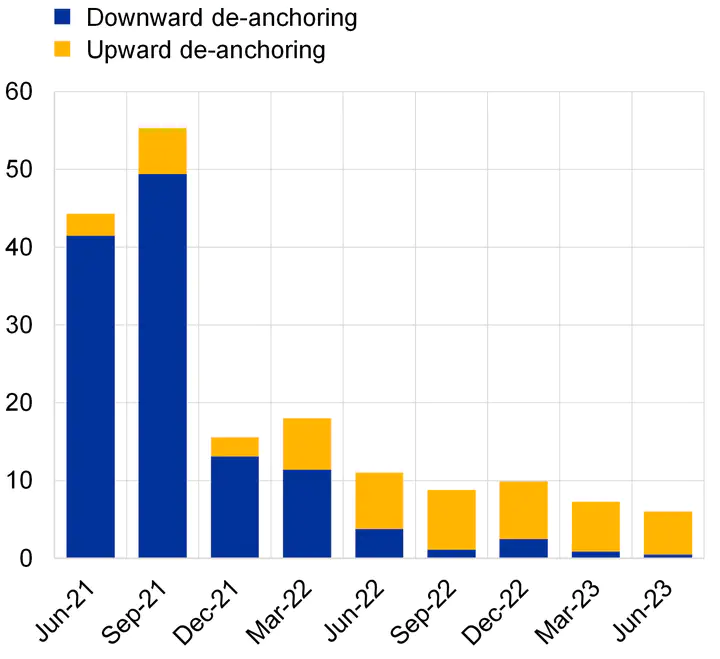

This paper investigates the implications of potential de-anchoring of medium-term inflation expectations for monetary policy. We propose a monetary policy framework, where the central bank considers de-anchoring risks in a regime switching model. We derive the optimal monetary policy strategy. Optimal monetary policy equates the welfare losses of a more forceful reaction to inflation with the welfare gains of safeguarding credibility. We propose to model de-anchoring risks using a medium-scale regime-switching DSGE model and derive a model-based approach to assess risks of inflation expectation de-anchoring from a real time perspective. We revisit the post-COVID inflation episode and conclude that an explicit looking-through strategy would have raised de-anchoring risks in the euro area to a limited extent.